January 17, 2023

As was reported in our Communications & Competition Newsletter last month (here), Openreach has published its latest wholesale FTTP price offering (otherwise known as ‘Equinox 2’). Equinox 2 amends and supplements Equinox 1 by introducing further discounts, as well as new terms and conditions.

Notification and Ofcom’s Consultation

Openreach notified Ofcom of Equinox 2 on the 14th December 2022 pursuant to SMP Condition 8.6 of the Wholesale Fixed Telecoms Market Review (WFTMR).[1] Ofcom will now consider whether the notified offer raises competition concerns requiring ex ante intervention and reach a provisional view.

If Ofcom concludes that there are competition concerns it needs to address through a direction to BT[2], it will consult on the proposed direction in accordance with the relevant statutory provisions.[3] If it decides there are no substantive concerns requiring ex ante intervention, it still intends to publish a consultation on the view.

In either case, Ofcom expects to publish a consultation in late January/early February 2023 giving stakeholders 30 days to respond – Openreach has set the provisional effective date of the offer to the 1st April 2023.

Whilst the offer itself appears to benefit downstream Internet Service Providers (ISPs) and consumer alike in terms of lower FTTP prices, it does raise a number of regulatory issues which Ofcom will no doubt need to address as part of its consultation.[4]

Among them is the specific issue around Openreach’s decision to price some of its bandwidths below the regulated 40/10 anchor product, in the context of Ofcom’s assessment and decision in Equinox 1. This will no doubt require both:

- Openreach to provide some form of explicit and objective justification as to the commercial and cost case for such an offering; and for

- Ofcom to either reiterate its position in Equinox 1 or explain any deviancy from either its approach or conclusions based on the same approach.

We briefly look at the offer below before going onto discuss potential stakeholder concerns and responses, closing off with a high-level cost-benefit analysis that Ofcom will have to undertake in assessing this offer.

Summary of the new features

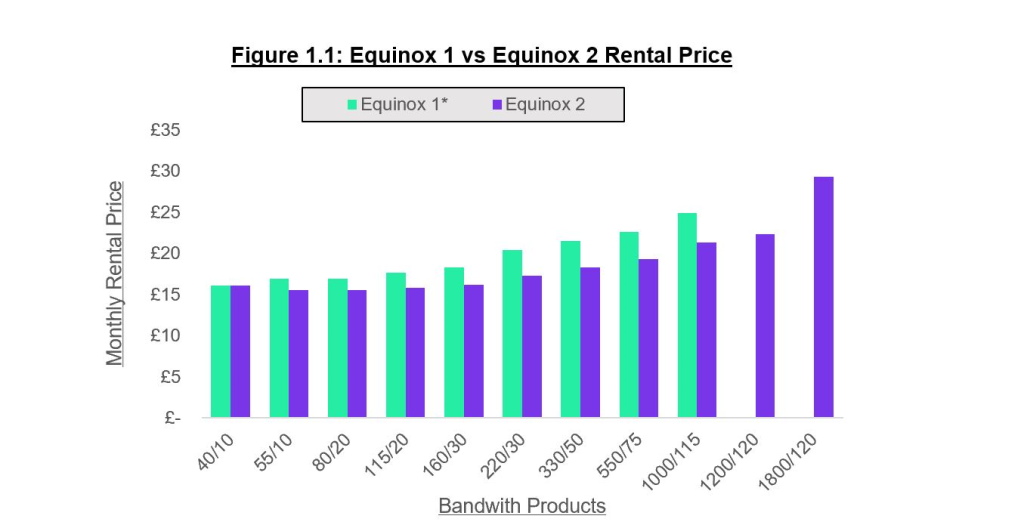

In this latest offering Openreach has dropped the rental price for all its FTTP products except for the regulated 40/10 anchor product. The discount levels range between 8% and 15% when compared to Equinox 1[5], with the larger discounts seen at the higher bandwidths.

Notes: *Equinox 1 adjusted for CPI as of FY 2023/24. Equinox 2 list prices are as of FY 2023/24,

Source: Equinox 2 (here) and Equinox 1 (here). Briefing (here)

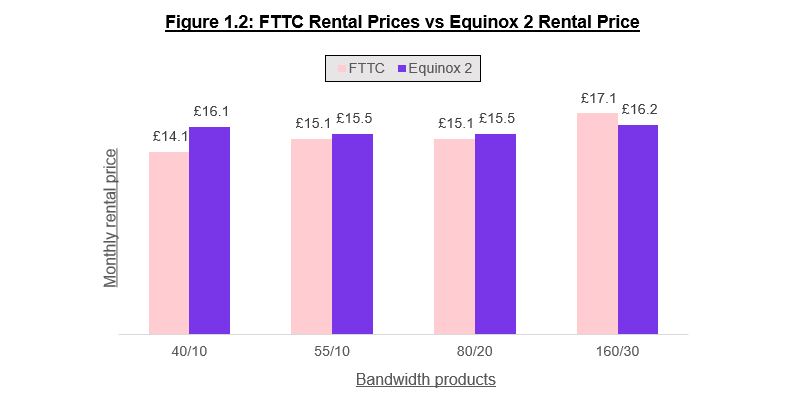

What’s more is the new prices have closed the gap with FTTC[6], reducing the cost incentive for downstream Communication Providers (CPs) to remain on legacy Openreach services.

Notes: Equinox 2 list prices are as of FY 2023/24, FTTC GEA Offer as listed for 2023. FTTC prices are calculated as GEA Offer + Regulated MPF (SML1) price.

Source: Equinox 2 (here) and FTTC GEA Offer (here). Briefing (here)

The erosion of the price differential between the two technologies is made more significant given that Ofcom allowed Openreach to charge a £1.70[7] fibre premium on the 40/10 FTTP product, on the grounds that it provides:

“the additional benefits to end-users having a more reliable broadband service with higher and more stable speeds (relative to broadband provided over copper with the same stated headline speed).

The additional benefits to access seekers purchasing a fibre broadband service as a result of cost-savings through delivering a more reliable service to customers; and lower exchange-based costs”.[8]

A position which Openreach itself made when arguing for the fibre premium in its consultation response:

“We believe a premium of at least £2 is justified given the improved overall service on an FTTP line compared to an FTTC line and the impacts this will have on an end-customer willingness to pay, reduced customer churn, etc, as well as the reduced costs CPs will face in using FTTP to supply services to their customers compared to the use of Copper/FTTC access services.“[9]

This latest price offering all but eliminates the fibre premium for bandwidths above the 40/10.

The bandwidth gradient and below 40/10 pricing

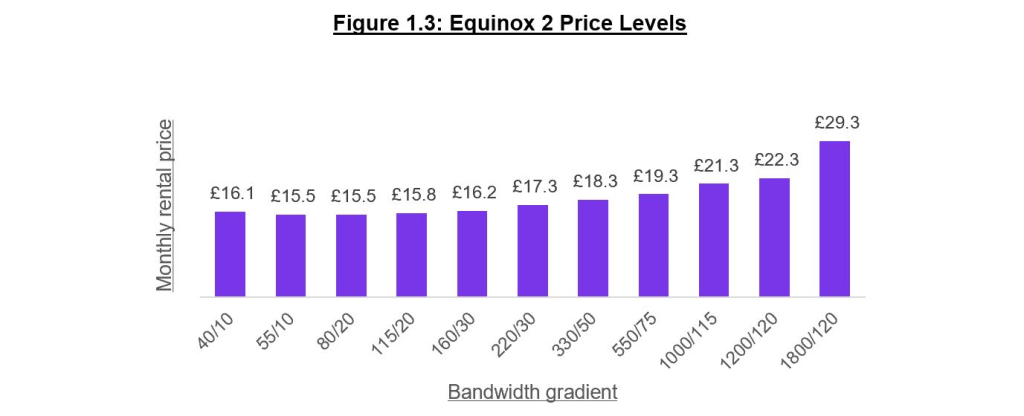

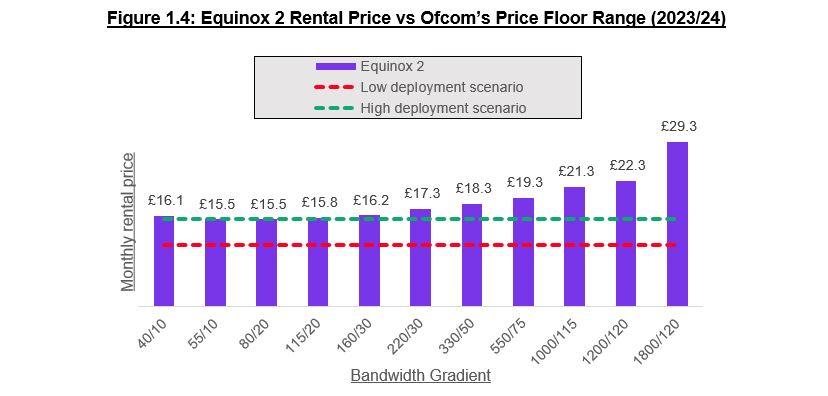

In its latest offering, Openreach has for the first time priced some of its FTTP products below the regulated 40/10 ‘anchor’ price (see Figure 1.3 below).

Notes: Equinox 2 list prices are as of 2023/24, Ofcom’s Fibre Cost Model produces a range of price points depending on the scale of the entrant operator. Low deployment scale is for a 2 million premise build, whilst a high deployment scale is for an 8 million premise build. We have estimated Ofcom’s Fibre Cost Model outputs by adjusting their initial WFTMR outputs in-line with CPI.

Source: Equinox 2 (here). Briefing (here). Fibre Cost Model (here). WFTMR Statement and new entrant price range (here).

As we explore in more detail below, this is an incredibly significant point as Ofcom has previously dismissed claims as to the anti-competitive effect of Equinox 1 on the basis none of the products were below the 40/10 anchor price nor its own estimates of what a new entrant requires to recover its efficiently incurred costs.

Failsafe Mechanism

The latest offer also includes a Failsafe Mechanism:

“to remove any theoretical possibility of distorting incentives to use alternative networks” and an explicit statement on “no volume or exclusivity requirements to obtain discounts”. [11]

The mechanism is described:

“in simple terms, the Failsafe Mechanism would allow a CP to define an ‘Overbuild Area’ where it is able to place orders with an alternative network supplier. Any orders placed with Openreach in this area – whether on copper or fibre – would be excluded from the calculation of Fibre Only performance”.[12]

The intended purpose is meant to alleviate concerns from both ISPs and altnets alike that they will be penalised in anyway were the downstream CP to utilise the Equinox 2 offer.

As Openreach states:

“any decisions to use an alternative network supplier in the Overbuild Area for any level of order volumes could not in any way affect the Fibre Only measure and, therefore, the level of discounts the CP would receiver”.

There is an additional caveat which allows Openreach to review and amend the Failsafe Mechanism if they see a “disproportionate level of orders on Openreach copper in the Overbuild Area”.

There also remains a concern around confidentiality rings and whether the altnets would want ISPs to necessarily share the required build and connection information with its biggest competitor, Openreach. Openreach tries to address these concerns by employing an independent 3rd party verifier to handle this information.

Likely stakeholder responses and views

Openreach

Openreach have ultimately rationalised this offer as a means of accelerating ISPs adoption of FTTP services by migrating their existing copper end customers to FTTP.[13]

This position isn’t completely new for Openreach having cited similar arguments for their commercial and strategic objective in Equinox 1.[14]

Arguably the Failsafe Mechanism and its design also substantiates the case this offer is meant to be pro-migration at its core, with exemption to the Failsafe only narrowly defined in situations where Openreach perceives there to be a slow adoption of FTTP services in Overbuild Areas.

However, this new offer does see the erosion of the fibre premium, particularly for higher bandwidth products. When taken in the context of lobbying for said premium by Openreach, this decision may raise a few eyebrows.[15]

Furthermore, the below the 40/10 pricing for some of its products will no doubt require some form of explicit and objective justification as to the commercial and cost rationale for such action.

Altnets

The altnets will have significant concerns about the latest price levels and the impact this has on effective competition emerging in the market.

General price drops

This offer has come at a time where all markets – for which this industry is no exception – costs are increasing significantly.[16]

With all the new challenges the market faces, as well as the unique barriers a new entrant altnet has when trying to win customers over from the incumbent, the ability for these new entrants to compete becomes that much more difficult under ever squeezing margins.[17]

It is therefore likely the altnets will spend some of their regulatory resource trying to argue against the general price drops being offered, with a particular focus on the impact said offer has on competition emerging in the market.

Price floor

Notwithstanding this, the specific issue of below the 40/10 pricing may be the primary focus of altnets wishing to contest Equinox 2.

What’s particularly significant about this issue is it requires Ofcom to address price floor regulation and anti-competitive pricing.

In its assessment of Equinox 1 price levels, Ofcom determined there was no apparent risk to competition on the basis the prices were neither below the FTTP 40/10 anchor product nor its estimated price range for a new entrant operator.

Ofcom’s provisional view, as outlined in its Consultation document on Equinox 1, was:

“we set a price ceiling for the FTTP 40/10 ‘anchor’ product but decided not to regulate the prices of Openreach’s higher speed products [……]. When setting the price ceiling for the FTTP 40/10 anchor product, we compared it with our estimate of the price that an entrant operator would need to charge in order to recover its efficiently incurred costs [as calculated using the Fibre Cost Model]’ [emphasis added].[18]

Ofcom reiterates this approach in its final statement:

“Under the Equinox Offer, the price for the FTTP 40/10 anchor product is set at the regulated price ceiling, i.e. it is not discounted. Further, all other FTTP rental prices under the Equinox Offer are set a level above this, including when ARPU-related discounts are taken into account. Therefore, we consider that the Equinox Offer prices are set at a level above our estimate of the price that an altnet would need to change in order to recover its efficiently incurred costs in Area 2. We consider that the level of the Equinox Offer discounts do not undermine our objective to promote investment in gigabit-capable networks by Openreach and other operators in Area 2”. [19]

There is no doubt altnets will want to lean on this rationale to (in the least) get Ofcom to mitigate the effects of Equinox 2.

ISPs

In stark contrast, downstream ISPs will likely welcome the new price levels and speak to the benefits of lower prices being passed onto consumers. Depending on their bandwidth mix they could see a saving of up to 15%, a welcomed deduction to their bills in what are trying times for all of industry.

They may however wish to also use the momentum and/or general direction of these successive discounts (i.e. Equinox 1 and 2) to reiterate previously held positions that the existing price caps are too high and that there is economic room for Ofcom to force Openreach drop these down further to cost.

There is also the additional complexity and cost of fulfilling the Failsafe Mechanism which may concern some of the ISPs. The granularity of the reporting mechanism and its frequency may have some ISPs challenging its utility and benefit to them.

Ofcom

If its position in Equinox 1 is anything to go by, it is unlikely Ofcom will presumptively see a general decrease in prices as averse to its strategic objective of promoting investment in gigabit capable networks, where available through effective competition.

If anything, it may wish to use this general decrease as evidence that the consumer benefits of their policy is on show for all to see (i.e. lower wholesale prices which can be passed onto consumers through lower retail prices). It may also then prove a useful tool to force ISPs to pass on these new savings to consumers.

They may however need to directly address specific price points in light of statements and decisions they made as part of the Equinox 1 assessment.

This leaves Ofcom in a very awkward position.

On the one hand if it chooses to rely on the same assessment it did for Equinox 1 then at least on the face of it, there is a strong case that it rejects Equinox 2 on the basis some of the price levels are below those which can be sustained by a reasonably efficient operator. Thus, concluding Equinox 2 in its current form harms Ofcom’s objective of promoting gigabit-capable network investment through effective competition at the wholesale level.

However, in doing so it will be taking quite a policy and politically fraught position, effectively intervening to inflate prices whilst simultaneously pushing for greater consumer protection and affordability in its other broadband-related workstreams.[20]

On the other hand, if it chooses to deviate from its Equinox 1 position it leaves the organisation wholly exposed to criticism, industry uproar and (most likely) legal appeals.

There is no easy answer for Ofcom in this case – as there rarely is – but there is no doubt with what is at stake for all concerned, the industry will be eagerly awaiting its view.

To find out more or discuss further, please get in touch

References

[1] Ofcom (2021). ‘Promoting competition and investment in fibre networks: Wholesale Fixed Telecoms Market Review 2021-2026. Volume 7: Legal Instruments’. Volume 7. Page 56. SMP Condition 8.6. (Link). As accessed 09/01/2023.

[2] Whilst the offer is in Openreach’s name, the SMP conditions and directions actually fall to BT Group.

[3] Section 49A Communications Act 2003.

[4] Ofcom has been notified of the offer and seeks to consult in late January/early February of this year. Stakeholders will have 30 days to respond from publication (Link). As accessed 09/01/2023.

[5] This accounts for inflation

[6] Factoring in both the GEA and Copper components (WLR or MPF) of the FTTC product.

[7] Tracking and rising with CPI annually.

[8] Ofcom (2021). ‘2021 WFTMR: Annexes 1-26’. Annex 19. Pages 272-273. Paragraph A19.13 – A19.14. (Link). As accessed 05/01/2023.

[9] Openreach (2020).’Promoting competition and investment in fibre network: Wholesale Fixed Telecoms Market Review’. Page 32. Paragraph 3.22. (Link). As accessed 05/01/2023.

[10] Ofcom (2021). ‘Promoting investment and competition in fibre networks: Wholesale Fixed Telecoms Market Review 2021-2026. Annex 15. Paragraph A15.85. (Link). As accessed 09/10/2023. The initial figures were £9,53 for a low deployment scenario and £13.67 for a high deployment scenario, per Ofcom’s WFTMR. For this analysis we have adjusted for inflation and produced 2022/23 rental prices for direct comparability.

[11] (Link) As accessed 06/01/2023.

[12] (Link) As accessed 06/01/2023.

[13] (Link) as accessed 06/01/2023.

[14] In its press briefing for Equinox 1 (01/07/2021) Openreach cite the following objectives for Equinox 1: “(i) Make GEA-FTTP the preferred technology through a simple CP commitment and competitive pricing; (ii) Offer extended pricing certainty across a broad choice of speeds, enabling CPs to create their own competitive and differentiated offers; and (iii) Align and simplify pricing and commitment structures across the Openreach GEA-FTTP footprint. Openreach (2020).’NGA2017/21 GEA-FTTP Equinox Offer’. (Link). As accessed 05/01/2023.

See also: Openreach (2021). ‘Call for Inputs: Openreach proposed FTTP offer starting 1 October 2021’. (Link). As accessed 05/01/2023.

See also: Openreach (2021). ‘Openreach response to Ofcom’s consultation “Openreach Proposed FTTP Offer starting 1 October 2021”’. (Link). As accessed 05/01/2023.

[15] (Link). As accessed 05/01/2023.

[16] As the name implies this is the second Equinox offer which Openreach has put into the market in just over a year. It has been preceded by the Local Marketing Offer (LMO) (Link), the GEA FTTP Offer v2 (Link) and for FTTC circuits the GEA Volume Discount (Link).

[17] CityFibre (2021). ‘CityFibre response to Ofcom’s consultation on Openreach’s Equinox Offer’. Page 18, Paragraph 3.6. (Link). As accessed 05/01/2023.

[18] Ofcom estimates the price for an entrant operator to recover its efficiently incurred costs to be between £9.53 and £13.67 per month (in 2020/21 prices). Ofcom (2021). ‘Promoting investment and competition in fibre networks: Wholesale Fixed Telecoms Market Review 2021-2026. Annex 15. Paragraph A15.85. (Link). As accessed 09/01/2023.

[19] Ofcom (2021). “Openreach Proposed FTTP Offer starting 1st October 2021.” Statement. Page 12. Paragraph 3.44 (Link). As accessed 10/01/2023.

[20] Last year Ofcom concluded in its affordability report that “9.1 million UK households are having difficulty affording communication services”. (Link) as accessed 09/01/2023. Ofcom (2021). ‘Openreach Proposed FTTP Offer starting 1 October 2021’. Paragraphs 2.30 – 2.31. (Link). As accessed 09/01/2023.

Expertise