August 1, 2019

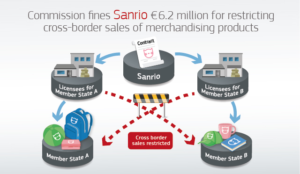

On 9 July 2019, the European Commission announced that it had fined Sanrio, a Japanese company that designs, licenses, produces and sells products featuring Hello Kitty and other animated characters, €6.2 million for banning traders from selling licensed merchandise to other countries within the EEA.

The licensed merchandise is extremely varied (e.g. mugs, bags, bedsheets, stationery, toys) but it carries one or more logos or images protected by intellectual property rights (IPRs), such as trademarks or copyright.

Background

In June 2017, the Commission opened a formal antitrust investigation into certain licensing and distribution practices of Sanrio to assess whether it illegally restricted traders from selling licensed merchandise cross-border and online within the EU Single Market. To read the European Commission Press Release in full, click here.

The Commission indicated that it would investigate whether Sanrio, in its role as a licensor of rights for merchandising products, may have breached EU competition rules by restricting its licensees’ ability to sell licensed merchandise cross-border and online.

The investigation into Sanrio came shortly after the Commission adopted its final report on the e-commerce sector inquiry on 10 May 2017 as part of its Digital Single Market strategy and was intended to complement the findings of that inquiry. The full text of the final report can be found here.

Decision

The Commission has found that Sanrio’s non-exclusive licensing agreements breached EU competition rules that prohibit anti-competitive agreements between companies (Article 101 of the Treaty on the Functioning of the European Union) by:

- imposing a number ofdirect measures restricting out-of-territory sales by licensees, such as clauses explicitly prohibiting these sales, obligations to refer orders for out-of-territory sales to Sanrio and limitations to the languages used on the merchandising products.

- implementing a series of measures (e.g. audit and the non-renewal of contracts) as an indirect way to encourage compliance with the out-of-territory restrictions.

According to the Commission Sanrio’s anti-competitive practices partitioned the Single Market and prevented licensees in Europe from selling products cross-border, to the ultimate detriment of European consumers.

Fine

The level of the fine took into account, in particular, the value of sales relating to the infringement, the gravity of the infringement and its duration, as well as the fact that Sanrio cooperated with the Commission during the investigation.

The €6,222,000 fine imposed includes a 40% reduction for Sanrio’s cooperation beyond its legal obligation to do so. In particular Sanrio provided the Commission with information that allowed it to establish the extended duration of the infringement. It also provided evidence with significant added value and expressly acknowledged the facts and the infringements of EU competition rules.

Enforcement Trend

Sanrio is the latest in a spate of competition law enforcement decisions relating to cross-border sales restrictions and other so-called vertical restraints.

In March 2019, the Commission fined Nike €12.5 million (including a 40% reduction for cooperation) for restricting cross-border sales of merchandising products bearing the brands of football clubs like FC Barcelona, Manchester United, Juventus, Inter Milan and AS Roma, as well as national federations like the French Football Federation. The Commission found that Nike’s non-exclusive licensing and distribution agreements breached EU competition rules by:

- imposing a number of direct measures restricting out-of-territory sales by licensees, such as clauses explicitly prohibiting these sales, obligations to refer orders for out-of-territory sales to Nike and clauses imposing double royalties for out-of-territory sales.

- enforcing indirect measures to implement the out-of-territory restrictions, for instance threatening licensees with ending their contract if they sold out-of-territory, refusing to supply “official product” holograms if it feared that sales could be going towards other territories in the EEA, and carrying out audits to ensure compliance with the restrictions.

- Using, in some instances, master licensees in each territory to grant sub-licences for the use of the different IPRs to third parties. To secure the practice through the whole distribution chain, Nike imposeddirect and indirect measures on master licensees, compelling master licensees to stay within their territories and to enforce restrictions vis-à-vis their sub-licensees.

- including clauses that explicitly prohibited licensees from supplying merchandising products to customers, often retailers, who could be selling outside the allocated territories. In addition to obliging licensees to pass on these prohibitions in their contracts, Nike would intervene to ensure that retailers (e.g. fashion shops, supermarkets, etc.) stopped purchasing products from licensees in other EEA territories.

In December 2018, the Commission fined clothing company Guess €40 million (including a 50% reduction for cooperation) for restricting retailers from online advertising and selling cross-border to consumers in other Member States (“geo-blocking”), in breach of EU competition rules. The Commission found that Guess’ distribution agreements restricted authorised retailers from:

- using the Guess brand names and trademarks for the purposes of online search advertising;

- selling online without a prior specific authorisationby Guess. The company had full discretion for this authorisation, which was not based on any specified quality criteria;

- selling to consumers located outside the authorised retailers’ allocated territories;

- cross-sellingamong authorised wholesalers and retailers; and

- independently deciding on the retail price at which they sell Guess products.

It is clear that the competition compliance risks for licensor of rights for merchandising products and for suppliers distributing goods online in Europe have increased significantly in the last two years. The Commission has indicated that it will continue to clamp down cross-border sales restrictions. There are a number of other ongoing investigations. In addition, the Commission is currently undertaking an evaluation of the Vertical Block Exemption Regulation, which expires on 31 May 2022.

For more information on the Sanrio investigation on the public case register, click here.

Expertise

Topics